Since April, the land auction craze that has emerged in some hot second tier cities has spread to some third - and fourth tier cities.

According to data from the CRIC Research Center, based on the performance of 299 third - and fourth tier cities it monitors, land transaction volume and price both increased in April, with a 30% month on month increase in construction area and a 19% month on month increase in average land transaction price. It is worth mentioning that the third and fourth tier cities in the Yangtze River Delta urban agglomeration are prominent. Among them, the popularity of land in cities such as Fuyang, Changzhou, Lishui, and Jinhua has significantly increased, and high premium plots have emerged frequently. For example, the floor price of a commercial and residential plot in Zhonglou District, Changzhou has broken through a historical high.

According to data from Zhongyuan Real Estate Research Center, local governments have accelerated the speed of land transfer since the second quarter. As of May 20th, the 50 monitored cities have cumulatively sold 1.37 trillion yuan of land this year, an increase of 9.3% year-on-year. 48 out of 50 cities have land transfer fees exceeding billions. Among them, Hangzhou City, with the highest amount of land transfer fees, achieved a land revenue of 112.9 billion yuan within the year. In addition, 14 cities including Beijing, Tianjin, Shanghai, and Suzhou have land revenues exceeding 30 billion yuan.

Industry analysis believes that the method of dividing markets by city level is outdated, and several large city clusters will be the core areas for the development of the real estate market. With the further promotion of urban agglomeration planning such as the Yangtze River Delta and the Guangdong Hong Kong Macao Greater Bay Area, some third - and fourth tier cities in the region will usher in new growth opportunities, especially those with population inflows and low land prices. Their land investment opportunities are worth paying attention to.

The phenomenon of high heat in soil auctions is transmitted to some third - and fourth tier cities

With the reduction of financing difficulties for real estate companies, some cities' land markets have shown signs of recovery, and the phenomenon of high land auction prices in some second tier cities has begun to spread to third - and fourth tier cities.

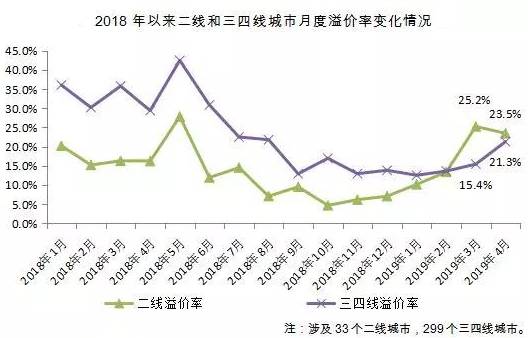

According to a report from the CRIC Research Center, following the second tier city land auction premium rate breaking through 25% in March and reaching a new high since the second half of 2018, the premium rate in third - and fourth tier cities has also ended its six-month low hover and experienced a significant rebound in April, with the premium rate increasing to 21.3%, nearly 10 percentage points higher than the beginning of the year.

Specifically, in April, several high-quality land parcels were sold in popular third - and fourth tier cities such as Wenzhou, Changzhou, Changshu, Jinhua, Wuxi, Foshan, Taizhou, and Zhenjiang.

In Wenzhou, a total of 16 transactions, including residential land, were completed in April, with a total revenue of over 10.4 billion yuan. Among them, 12 land transactions had a premium rate of over 25%.

Changzhou is no exception, with 5 out of 8 residential land parcels sold in April all having a premium rate of over 50%. One commercial and residential plot located in Zhonglou District went through 77 rounds of bidding and was ultimately won by Xincheng, with a premium rate of 86% and a floor price of 15665 yuan/square meter, setting a new high for residential land floor prices in Changzhou and becoming the new "land king".

On April 4th, the winner of the XDG-2019-3 plot on the north side of the New Fourth Courtyard in Binhu District was selected through a lottery. Rongchuang won the plot with a floor price limit of 18000 yuan/square meter and a total price of 2.422 billion yuan, which is only 50 yuan/square meter lower than the historical highest price in Wuxi.

Positive factors such as population influx provide support for the future development of some cities. As a populous city in Anhui, Fuyang has long been a typical outflow city. However, in recent years, due to factors such as significant population return and the opening of high-speed rail, the heat of the second tier city land market has also been transmitted to Fuyang. According to the CRIC Research Center, in April, there were 15 plots of land in Fuyang with a premium rate exceeding 30%, ranking first among third - and fourth tier cities.

There are countless such situations mentioned above, which have gradually increased the heat of the land market in third - and fourth tier cities.

Cities within urban agglomerations deserve attention

However, it is worth noting that the current land market in third - and fourth tier cities has not fully recovered. The report from the CRIC Research Center points out that high premium land parcels are still concentrated in a small number of cities. According to data recently released by the National Bureau of Statistics, the land purchase area and land transaction price of real estate development enterprises have both decreased by more than 30% in the first four months of this year, and the decline has also expanded compared to January to March.

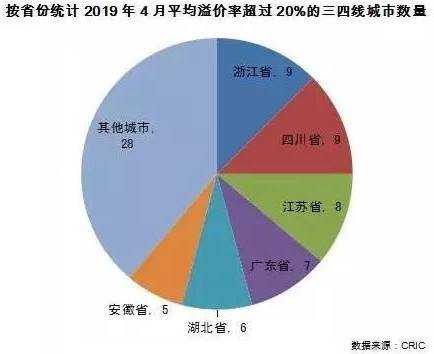

Among the 299 sample cities monitored by the CRIC Research Center, only 72 cities have a premium rate exceeding the average line of 20%. In terms of regional distribution, 22 cities are located in the three provinces of Jiangsu, Zhejiang, and Anhui, which shows the popularity of the land market in the Yangtze River Delta. In addition, there are also many cities in Sichuan, Guangdong, and Hubei with high land premium rates, which have attracted the attention of a large number of real estate companies.

Specifically, Guangdong, which enjoys favorable conditions in the Greater Bay Area, has shown outstanding performance, with an average premium rate of over 40% in Dongguan, Jiangmen, and Zhuhai; Zhejiang, located in the Yangtze River Delta, had a premium rate of over 15% at the prefecture level and city level in April, with several plots of land in Taizhou, Shaoxing, and Lishui having a premium rate exceeding 100%; The differentiation between hot and cold land in Sichuan is quite obvious. For example, Yibin and Guangyuan have the advantage of upgrading transportation facilities such as high-speed rail and airports, and the heat of the land market is significantly higher. The land auction premium rates have reached 144% and 55% respectively, while the land markets in Luzhou and Meishan are relatively quiet, with an average premium rate of less than 3%.

In the view of the CRIC Research Center, the recovery of third - and fourth tier cities is partly due to the conduction effect of high heat in second tier cities, but the fundamental support point is still the many favorable factors brought about by the integrated development of urban agglomerations.

Industry analysts believe that the land market heat in the Yangtze River Delta and Guangdong Hong Kong Macao Greater Bay Area has significantly increased, due to the rebound in housing prices in both regions, as well as favorable planning and rapid population inflows, which have greatly stimulated the enthusiasm of real estate companies to acquire land. In addition, after years of development, China's real estate market has become differentiated, and the method of dividing the market by city level is outdated. In the future, urban agglomerations such as Beijing Tianjin Hebei, Yangtze River Delta, Guangdong Hong Kong Macao Greater Bay Area, and the metropolitan areas within these agglomerations will be the core areas of China's real estate market, and lower level cities in these areas will have good development space.

For real estate companies, the CRIC Research Center stated that they should not completely withdraw from third - and fourth tier cities due to factors such as rapid demand release in recent years, declining old renovation targets, and risk regulation. Enterprises should focus on third - and fourth tier cities within the concept of urban agglomeration integration, while reasonably assessing policy risks. With the further promotion of urban agglomeration planning such as the Yangtze River Delta and the Guangdong Hong Kong Macao Greater Bay Area, and the accelerated transfer of industries from central cities, some third - and fourth tier cities may usher in new opportunities for demand growth, especially those cities such as Huzhou, Xuancheng, and Fuyang where employment opportunities are rapidly increasing. Given that the overall land price to housing price ratio is less than 0.5, land investment opportunities are more worthy of attention.

However, the Ministry of Housing and Urban Rural Development has recently issued warnings and reminders to 10 cities with overheated markets, and some cities have also strengthened their real estate market regulation. Ke Errui believes that if the land prices in hot third - and fourth tier cities continue to rise rapidly, local regulatory authorities will quickly follow up. Based on the land transaction situation in early May, the heat of the land market in third - and fourth tier cities has eased to some extent, with the premium rate dropping to 15%, a decrease of 6.3 percentage points compared to April.

How long can the rebound of third - and fourth tier soil auctions last?

In response to the recent phenomenon of high heat and high premium land parcels in the local market, second tier cities have taken the lead in implementing regulatory measures. For example, cities with significant market fluctuations such as Hefei, Changsha, Xi'an, and Suzhou have implemented tightening policies such as lowering the maximum land price limit, suspending the preferential deed tax for second homes, activating the risk control of housing provident fund, and restricting sales. In particular, Suzhou's regulatory measures for the sale of new houses in the entire park and some key areas of the high-tech zone for a period of three years, and the sale of all second-hand houses in the entire park for a period of five years, are landmark signals.

According to the analysis of CRIC Research Center, if the land prices in hot third - and fourth tier cities continue to rise rapidly, local regulatory authorities may quickly follow up, especially in cities such as Changzhou and Wuxi where land auctions are overheated and land prices have reached historical highs. There is a greater possibility of increased regulation and control, so caution should be exercised in the land auction market.

On the one hand, based on the land transaction situation in early May, the urban heat in third - and fourth tier cities has eased to a certain extent, with the premium rate dropping to 15%, a decrease of 6.3 percentage points compared to April. From this perspective, the warning issued by the Ministry of Housing and Urban Rural Development has been effective. Real estate companies are gradually lowering their market expectations and returning to rational land acquisition. Next, land prices in third - and fourth tier cities will return to the "moderate rise" expected by the Ministry of Natural Resources.

On the other hand, from the perspective of the supply scale structure of the land market, the third and fourth tier will still be the main force in land transactions, accounting for at least 70% of the national land market share. The Ke Er Rui Research Center pointed out that it is not advisable to completely withdraw from the third and fourth tier due to factors such as rapid demand release in recent years, declining old renovation targets, and risk regulation. In addition, based on a reasonable assessment of policy risks, attention can be focused on third - and fourth tier cities that benefit from the concept of integrated city clusters.

Source: Ke Er Rui Research Center, China News Network, Economic Reference News, and Comprehensive Compilation by China Real Estate Network